Sep 12, 2015; Dallas, TX, USA; A general view of the DraftKings sign board during the match with FC Dallas playing against New York City FC at Toyota Stadium. Mandatory Credit: Matthew Emmons-USA TODAY Sports

- DraftKings announced a new winning bet tax for four states

- The tax will go into effect on Jan. 1, 2025

- The tax will vary from state to state

DraftKings certainly ruffled some feathers among the betting community during its Q2 earnings report this afternoon.

The sports betting giant announced it will be implementing a “gaming tax surcharge” on winning bets in New York, Illinois, Vermont, and Pennsylvania.

The tax will vary from state to state, but was described by DraftKings representatives as “nominal.”

Implementing in States with High Rates

The new tax will be implemented in “high tax online sports betting states that have multiple operators (Illinois, New York, Pennsylvania, and Vermont) to ensure an operational effective tax rate of approximately 20%,” according to the company’s Q2 earnings report.

New York features an online sports betting tax rate of 51%, Illinois a rate of 20% to 40% depending on the sportsbook’s adjusted gross revenues (likely a 40% rate each month), Pennsylvania a flat rate of 36%, and Vermont a rate of 31% for the operator.

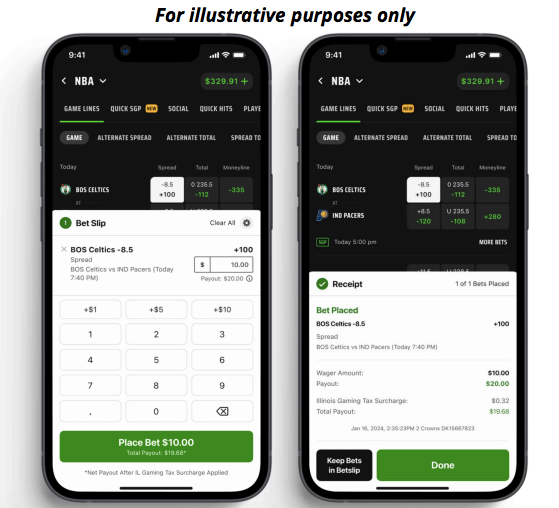

The new winning bet tax will be implemented in the four states beginning Jan. 1, 2025. While the rate will vary from state to state, in the DraftKings report the company showed a winning +100 odds ticket for $10 in Illinois winning a total of $19.68, instead of the usual $20.

This puts the odds of that ticket at just about -103 with the new tax.

The gaming tax surcharge will be clearly identified on each winning ticket, according to the company.

DraftKings Chief Executive Officer and Co-founder Jason Robins touched on the new tax in the company’s Q2 press release.

“Additionally, we plan to implement a gaming tax surcharge in high tax states that have multiple mobile sports betting operators on January 1, 2025 which could drive Adjusted EBITDA upside on an annual basis,” he said.

Will Tax Move Into Other DK States?

The new excise tax on winning bets was met with consternation from sport bettors.

“If you bet in IL, NY, PA, or VT get a load of this. DraftKings will be adding a SURCHARGE to be subtracted from YOUR net winnings to pay for THEIR TAX on gambling revenue. The money they make from losing bettors. Wow. Just wow,” Captain Jack Andrews (not his real name), professional sports bettor and co-founder of Unabated, posted on social media platform X.

It will be interesting to see if DraftKing implements the new tax rate elsewhere. Massachusetts and Ohio both have 20% tax rates, the next most expensive rate in states where DraftKings operators, and would likely be the next target for the company if the tax is expanded.

Could this also be a new tool for operators to use to combat what they perceive as high tax rates? If the new tax on winning bets doesn’t seriously impact DraftKings business, it’s not unfair to think other operators such as FanDuel, Caesars Sportsbook, or ESPN BET would consider implementing their own tax as well.

Rob covers all regulatory developments in online gambling. He specializes in US sports betting news along with casino regulation news as one of the most trusted sources in the country.

DraftKings, one of the leading online sports betting platforms, has announced that they will be implementing a new bet tax policy beginning January 1, 2025. This new policy is aimed at ensuring compliance with tax regulations and providing transparency for users.

Under the new policy, users will be required to pay a small tax on each bet placed on the DraftKings platform. The exact amount of the tax has not yet been disclosed, but it is expected to be a small percentage of the total bet amount. This tax will be automatically deducted from the user’s account at the time the bet is placed.

DraftKings has stated that the implementation of this new bet tax policy is necessary in order to comply with changing tax regulations in various jurisdictions where they operate. By collecting and remitting taxes on behalf of their users, DraftKings aims to simplify the process for users and ensure that they are in compliance with all relevant tax laws.

While some users may be disappointed by the introduction of this new tax, it is important to remember that taxes are a necessary part of operating a legal and regulated sports betting platform. By implementing this new policy, DraftKings is demonstrating their commitment to operating in a transparent and responsible manner.

Overall, the implementation of this new bet tax policy by DraftKings is a positive step towards ensuring compliance with tax regulations and providing transparency for users. It is important for users to be aware of this new policy and to understand how it may impact their betting activity on the platform.