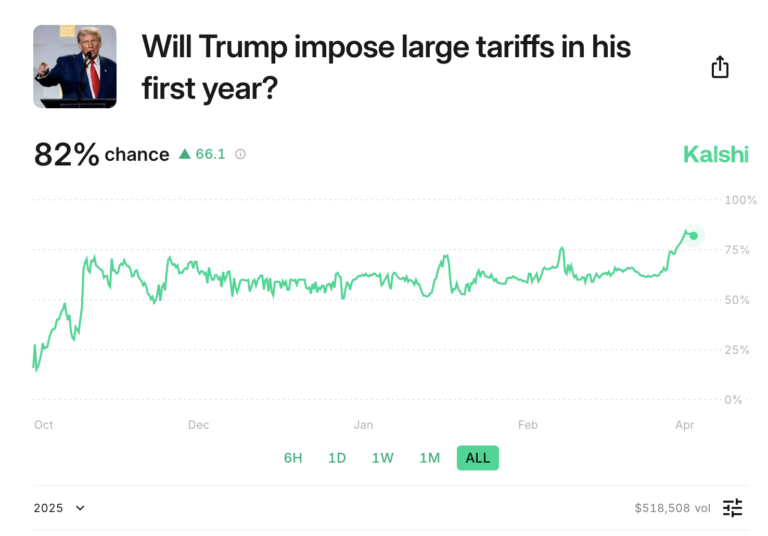

- Kalshi has posted several prediction markets on tariffs, including when Trump will impose tariffs, and which countries will answer back

- The current tariff odds heavily favor new tariffs before the end of the month, with the EU, Mexico and Canada the most-likely targets

- See the full list of Donald Trump-related tariff odds and prediction markets at Kalshi

News outlets the world over are ablaze with talk of tariffs. President Donald Trump has threatened to impose tariffs on several countries in his first few days in office. Monday brought something of an armistice as Trump delayed imposing tariffs on Mexico, and scheduled a follow-up call with Canadian Prime Minister Justin Trudeau. Nonetheless, prediction site Kalshi has posted half-a-dozen tariff-focused markets, and the tariff odds almost universally favor imposition of new measures in the near future.

Donald Trump Tariff Odds & Prediction Markets

The final prop in the table, above, is worded subjectively. The relevant page at Kalshi clarifies that “[i]f … the U.S. average weighted tariff is at least 6% by Q4 2025, then the market resolves to Yes. Outcome verified from FRED.” So there is an objective benchmark by which the outcome will be determined.

Prices and percentages from Kalshi at 5:20 pm ET, Feb. 3, 2025. New users can use SBD’s Kalshi promo code to get a bonus on their first purchases.

Kalshi contracts always pay out $1 or $0, depending on the final outcome. For instance, if you by “YES” on Trump imposing new tariffs before March at 88¢, and he does impose tariffs in February, you will get $1 (or 12¢ in profit) for each contract you purchased at that 88¢ price.

If he doesn’t impose tariffs in February, “YES” contracts do not return any money.

Generally, Kalshi users can sell any open contracts before the relevant prediction market settles, as long as there is a willing purchaser for said contract. This is akin to the “cashout” option at traditional sportsbooks, but since users are not selling their contracts to a sportsbook (or “the house”), such sales actually return the true equity in the contracts.

Will Trump Impose Tariffs on the USA’s Closest Neighbors and Allies?

Only three countries/regions are listed in the predictions markets for new US tariffs: the European Union and America’s neighbors to the north and south, Canada and Mexico.

Currently, the average contract price for “YES” on the European Union is a high 82¢, with the “NO” trading at just 25¢. Kalshi’s forecast, which is based on the most-recent trading activity, puts the true chances of “YES” winning this market at a massive 86%.

In sports-betting terms, the “YES” would be somewhere between a -450 and -650 favorite based on these numbers, while the “NO” would be a +300 to +400 underdog.

The prices for Mexico and Canada aren’t much different. Mexico is has the second-highest “YES” price at 75¢, with Canada trading at 72¢.

Which Countries Will Impose Tariffs on the USA?

Unsurprisingly, as Trump saber-rattles about his wide-ranging tariff plans, other countries have threatened retaliatory measures against the United States.

Kalshi’s prediction market on which countries will impose tariffs on the US set China as a heavy favorite at 96%, with the “YES” currently trading at 97¢, just two cents off the 99¢ maximum before being taken off the board.

Then comes the three trade partners discussed in the previous section: the EU (YES 85¢/NO 20¢), Mexico (YES 83¢

23¢), and Canada (79¢/26¢).

Only two of the nine countries listed in this market have a forecast below 50%: India (42%) and Japan (40%).

Prediction Markets Show High Likelihood of New Tariffs by March in Donald Trump Administration

As the Trump administration continues to navigate the complex landscape of international trade, prediction markets are indicating a high likelihood of new tariffs being implemented by March. These markets, which allow individuals to bet on the outcome of future events, have been closely watched by analysts and investors for insights into potential policy changes.

One of the key factors driving these predictions is President Trump’s stated commitment to protecting American industries and jobs through trade policies that prioritize domestic production. This protectionist stance has already led to tariffs on a wide range of goods, including steel and aluminum, as well as a trade war with China.

Additionally, recent developments in trade negotiations with countries like Mexico and Canada have raised concerns about the potential for new tariffs to be imposed in the near future. The uncertainty surrounding these negotiations has contributed to the volatility in prediction markets, with many participants hedging their bets on the likelihood of new tariffs being implemented.

While the exact details of any new tariffs remain unclear, analysts believe that they could target a variety of industries, including automotive, technology, and agriculture. These tariffs could have far-reaching implications for both American businesses and consumers, potentially leading to higher prices for imported goods and disruptions in supply chains.

In response to these predictions, businesses are already taking steps to prepare for the possibility of new tariffs. Some companies are diversifying their supply chains to reduce reliance on imports, while others are stockpiling inventory to mitigate potential price increases.

Overall, the high likelihood of new tariffs being implemented by March underscores the ongoing uncertainty surrounding US trade policy under the Trump administration. As businesses and investors continue to monitor developments in trade negotiations, prediction markets will remain a valuable tool for gauging the potential impact of future policy changes on the economy.